Business Insurance in and around Smithtown

One of Smithtown’s top choices for small business insurance.

Helping insure businesses can be the neighborly thing to do

Cost Effective Insurance For Your Business.

You've put a lot of elbow grease into your small business. At State Farm, we recognize your efforts and want to help insure you and your business, whether it's a HVAC company, a confectionary, a toy store, or other.

One of Smithtown’s top choices for small business insurance.

Helping insure businesses can be the neighborly thing to do

Customizable Coverage For Your Business

When one is as driven about their small business as you are, it is understandable to want to make sure everything has been thought of. That's why State Farm has coverage options for surety and fidelity bonds, worker’s compensation, artisan and service contractors, and more.

Since 1935, State Farm has helped small businesses manage risk. Get in touch with agent Jennifer O'Brien's team to discover the options specifically available to you!

Simple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

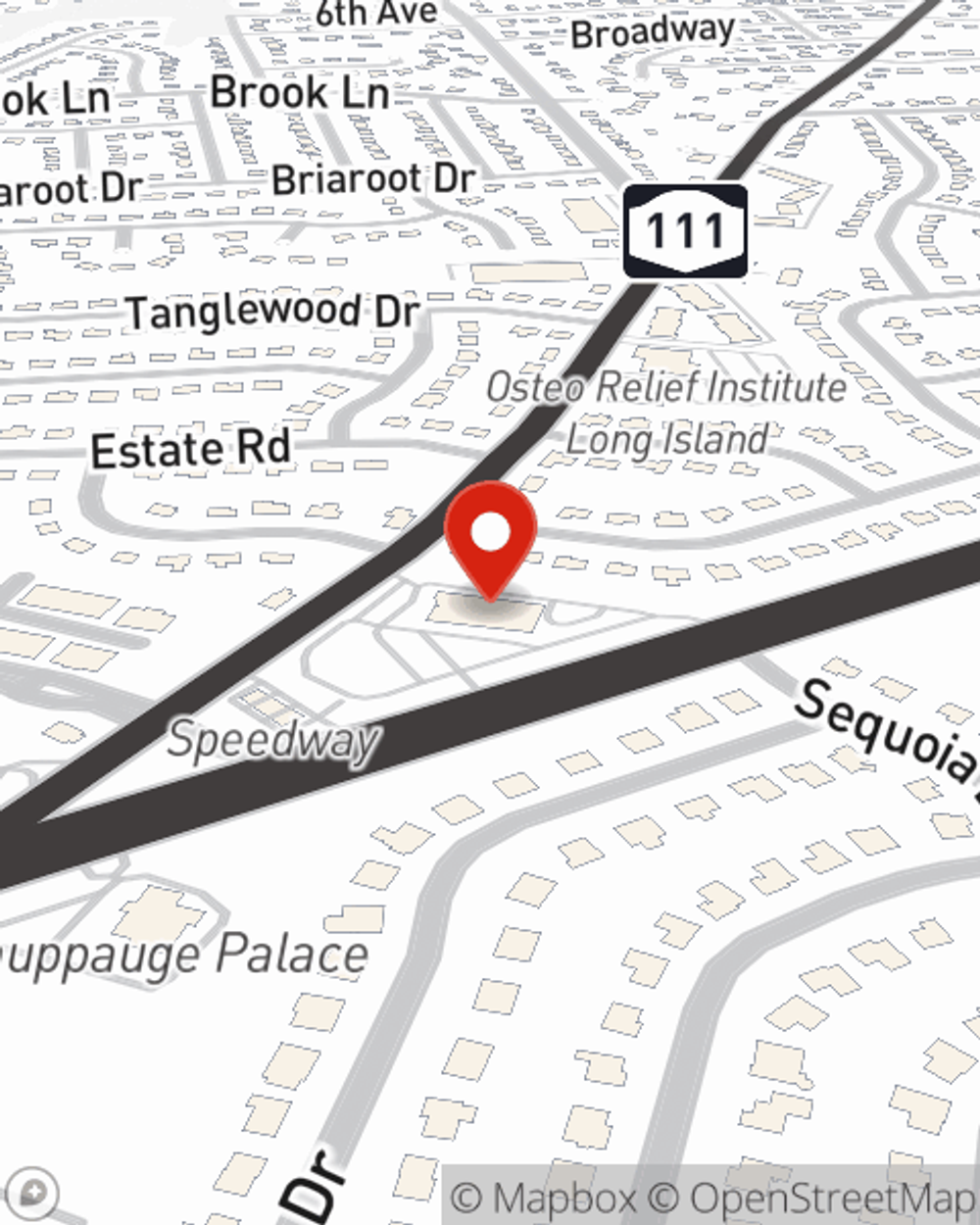

Jennifer O'Brien

State Farm® Insurance AgentSimple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.